```markdown

Unlock Net Worth Real Estate: Investing Smart in Downturn [Reference] Expert Insights

Want to grow your wealth through real estate? It's more than just buying a house. It's about playing it smart, understanding the market, and making savvy moves. This guide is your friendly roadmap to navigating today's real estate world. We'll show you how to spot hidden gems needing a little TLC, protect your investments for the long haul, and make the most of your real estate dollars. Whether you're a pro or just dipping your toes in, we'll give you the inside scoop on making profitable property decisions, no matter what the economy throws our way. Check this site for more info on net worth.

Navigating Net Worth Real Estate Like a Pro: Investing Smart When Times Are Tough

Is a market downturn a sign to run for the hills, or a golden opportunity to seriously grow your net worth real estate holdings? Truth is, while economic slumps can feel a bit scary, they often open doors for smart folks who know how to play the game. This guide is your playbook to capitalize on real estate market analysis.

Spotting Those Hidden Gems: Where the Real Deals Are

Think of a downturn like a giant treasure hunt for investment properties. The prize? Properties that are ripe for the picking. But how do you find the "X" that marks the spot? A good starting point is focusing on sectors that tend to hold up well, even when things get shaky. We're talking about residential properties – people always need a place to live. Industrial real estate is another strong contender, thanks to the ever-growing world of online shopping and the need for warehouses.

But it’s not just about what you buy, but where. Look for areas that are poised to bounce back stronger than others. Maybe it's a neighborhood with new development plans or a city attracting young professionals. Doing your research is key to identify underserved markets.

And speaking of the properties themselves, seek out those with untapped potential. The fixer-uppers. The ones that need a little love to truly shine. These "diamonds in the rough" often offer the biggest returns. Hunting for potential property investment can really pay off.

The Magic of Makeovers: Renovations That Pay Off Big

Ever get hooked on those home renovation shows? There's a reason they're so popular – a little updating can dramatically increase a property's appeal (and value). These property enhancements add a lot to a building.

Strategic renovations are absolutely crucial. Think about it: a fresh coat of paint can make a room feel brand new. An updated kitchen becomes the heart of the home, enticing potential buyers or renters. It's all about maximizing your return with smart, targeted improvements that deliver a quick turnaround.

But with so many options, which renovations give you the most bang for your buck? Data suggests that focusing on kitchen and bathroom updates typically yields the highest returns. However, don't underestimate the power of curb appeal. A well-maintained lawn, fresh landscaping, and an inviting entryway can significantly increase a property's perceived value. To maximize profitability, prioritize high-return renovations.

Funding Your Dreams: Loans and Smart Strategies

Okay, so you've found the perfect property and have a vision for its transformation. But how do you actually pay for it all? This is where smart financing comes into play. Don't be afraid to explore commercial loan products specifically designed for real estate rehabilitation.

What makes a loan "good"? Keep an eye out for loan offers with flexible terms and interest rates that align with your specific strategy. Securing suitable financing options is key.

Remember, interest rates can have a big impact on your profits, so it is advisable to shop around and compare offers before settling on a lender. Look at local banks and credit unions, as well as online lenders specializing in real estate. Always compare interest rates.

Tailoring Your Approach: Strategies for Different Players

The real estate game isn't one-size-fits-all. What works for a solo investor might not be the best approach for a large investment firm. Let's break down some targeted strategies for different players in the market:

| Stakeholders | Short-Term (0-1 Year) | Long-Term (3-5 Years) |

|---|---|---|

| Individual Investors | Target residential or industrial properties with renovation potential. Secure rehab financing with flexible terms. Partner with contractors and agents you can trust implicitly. Take advantage of online resources and tools for property management. | Diversify your holdings across different property types and locations to reduce risk. Explore emerging markets with growth potential. Keep a close eye on macroeconomic trends to anticipate market shifts. Invest in energy-efficient upgrades to attract environmentally conscious renters or buyers. Be prepared to hold properties through market cycles. |

| Real Estate Investment Firms | Utilize data analytics to identify undervalued assets and predict future growth areas. Streamline renovation processes to maximize efficiency and minimize costs. Look to offer financing solutions to smaller investors or developers. Some believe Forbes may be right in noting that some Real Estate Billionaires are still making money in 2023 | Develop sustainable properties that meet the growing demand for environmentally responsible buildings. Explore alternative asset classes like student housing or senior living facilities. Advocate for responsible real estate development practices that benefit communities and the environment. |

| Lending Institutions | Offer flexible rehab financing options tailored to specific property types and locations. Develop partnerships with contractors and developers to streamline the lending process. | Develop innovative financing options for the evolving market, such as crowdfunding platforms or green building loans. Collaborate with developers to fund sustainable projects and promote responsible real estate development. |

Shielding Yourself: Mitigating Risks in a Downturn

Let's be real – real estate investing always involves some level of risk. No matter how careful you are, things can still go wrong. But by taking proactive steps, you can minimize those potential downsides and protect your investments. Always consider risk management strategies.

Due diligence is your best friend. Before you plunk down a single dollar, thoroughly research the property, the location, and any potential risks. Check for things like environmental hazards, zoning restrictions, and potential legal issues. Perform thorough property research.

Building for the Future: Creating Your Real Estate Empire

Building net worth real estate isn't a quick get-rich-scheme. It's a long game, a marathon, not a sprint. The key is to focus on long-term growth by diversifying your portfolio and staying informed about market trends. It's about long-term investment strategies.

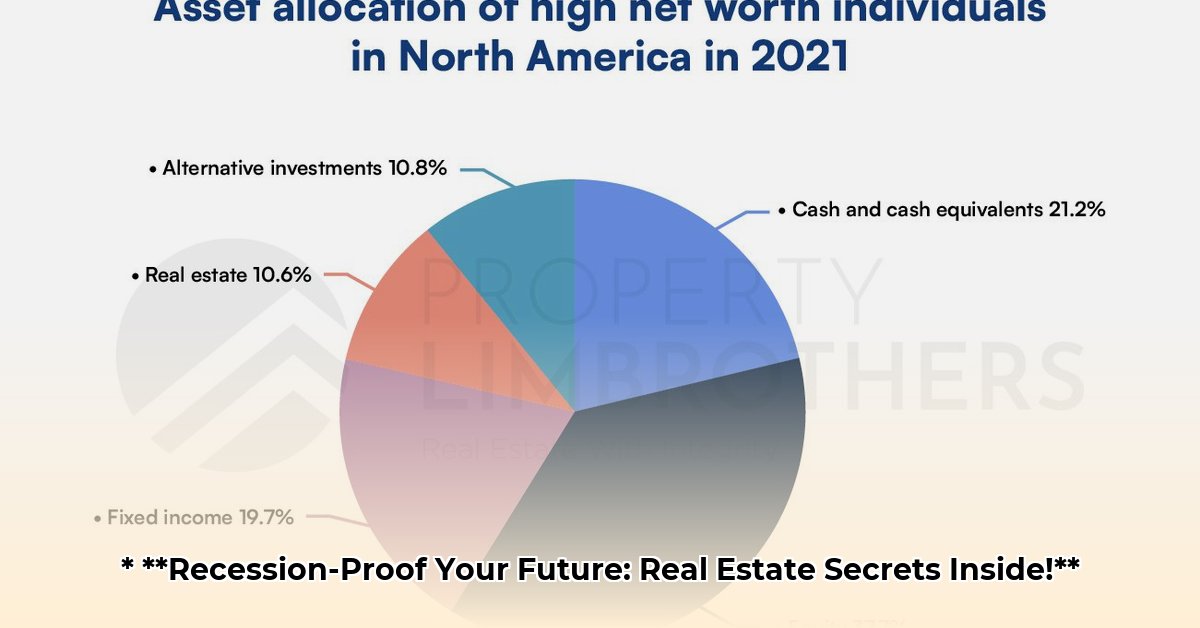

Experts suggest that having a mix of residential, commercial, and even international properties can help you weather economic storms. It's also vital to stay up-to-date on the latest news and developments in the real estate world. Attend industry events, read trade publications, and network with other investors to gain valuable insights.

By taking these steps, you can not only survive a downturn but also thrive and build a substantial portfolio.

How to Finance Property Rehabilitation: Your Guide to Rehab Loans

Key Takeaways:

- Rehab loans are vital for covering acquisition and renovation expenses.

- FHA 203(k), Fannie Mae HomeStyle, and hard money loans offer different terms and requirements.

- Hard money loans are faster but pricier.

- Understanding Loan-to-Value ratios is crucial.

- Accurately estimating costs can unlock opportunities with hard money lenders.

Understanding Rehab Loans

So, you've found a diamond in the rough – a property with potential just waiting to be unlocked. But how to finance property rehabilitation? Rehab loans are your answer. They cover both the purchase (or refinance) and the renovation costs. Think of it as a one-stop-shop for funding your fixer-upper dreams. These are your rehab loan advantages.

Decoding Your Loan Options

Navigating rehab loan options can feel like deciphering a secret code. FHA 203(k), Fannie Mae HomeStyle, and hard money loans each come with their own set of rules. Let's break them down:

- FHA 203(k) Loans: These require a minimum of $5,000 in rehab costs. One source says you might get approved with a credit score as low as 500 (with a 10% down payment), while another insists on a minimum of 580. Who's right? Check directly with your lender to understand FHA loan requirements.

- Fannie Mae HomeStyle Renovation Mortgages: These also combine purchase and renovation into a single mortgage. Specific Loan-to-Value (LTV) percentages can vary, so do your homework. Understand unique mortgage options.

- Hard Money Loans: Need cash fast? Hard money lenders prioritize speed, but be prepared for higher interest rates. They often focus on the After Repair Value (ARV), opening doors for savvy investors who know how to estimate renovation costs accurately. Prioritize fast funding.

Making It Actionable: A Stakeholder's Perspective

Financing rehabs isn't a solo game; it